by nuddleman | Jun 18, 2021 | COVID-19, New Laws

New COVID-19 Workplace Regulations Cal-OSHA finally issued new COVID-19 workplace rules regarding employer obligations related to COVID-19 in the workplace. An executive order from Gavin Newsom makes the regulations effective immediately. Note that this article is...

by nuddleman | Oct 26, 2020 | COVID-19, Discrimination & Harassment, New Laws, Wage & Hour

End of Legislative Session Brings Several Changes to the California Workplace The combination of the continuing COVID-19 pandemic and the clock running out on this year’s legislative session produced a lot of tweaks to California employment law, ranging from workers’...

by nuddleman | Sep 17, 2020 | Discrimination & Harassment, New Laws, Policies

The Federal Family Medical Leave Act (“FMLA”) and the state equivalent California Family Rights Act (“CRFA”) require employers with 50 or more employees working within a 75-mile radius to provide up to 12 weeks of unpaid time off for serious or chronic medical...

by nuddleman | Aug 24, 2020 | Discrimination & Harassment, New Laws, Policies, Presentations

California employers with 5 or more employees must provide sexual harassment prevention training for all employees every two years. Supervisors must receive 2-hours of training. All other employees must receive at least 1-hour of training. The training must cover...

by nuddleman | Jun 30, 2020 | New Laws, Wage & Hour

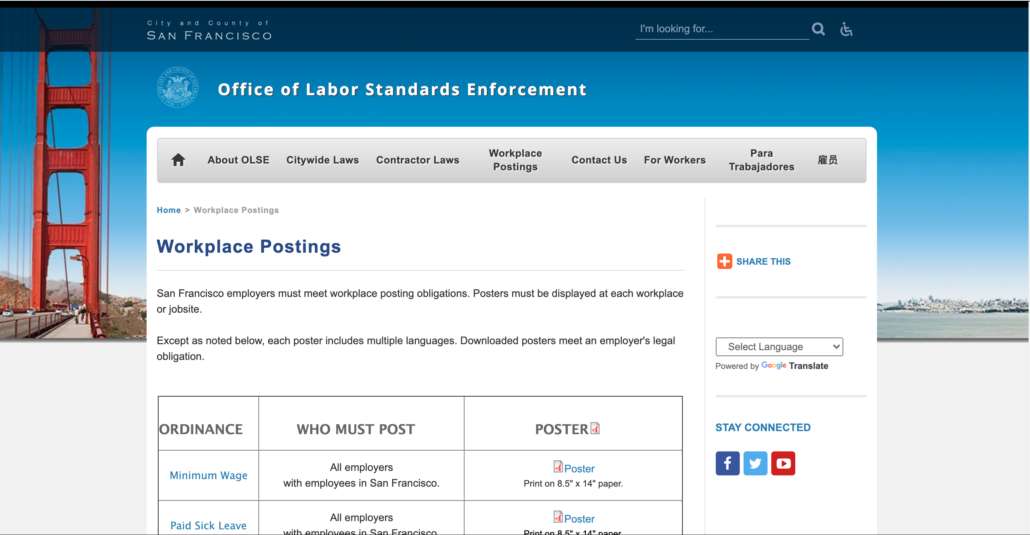

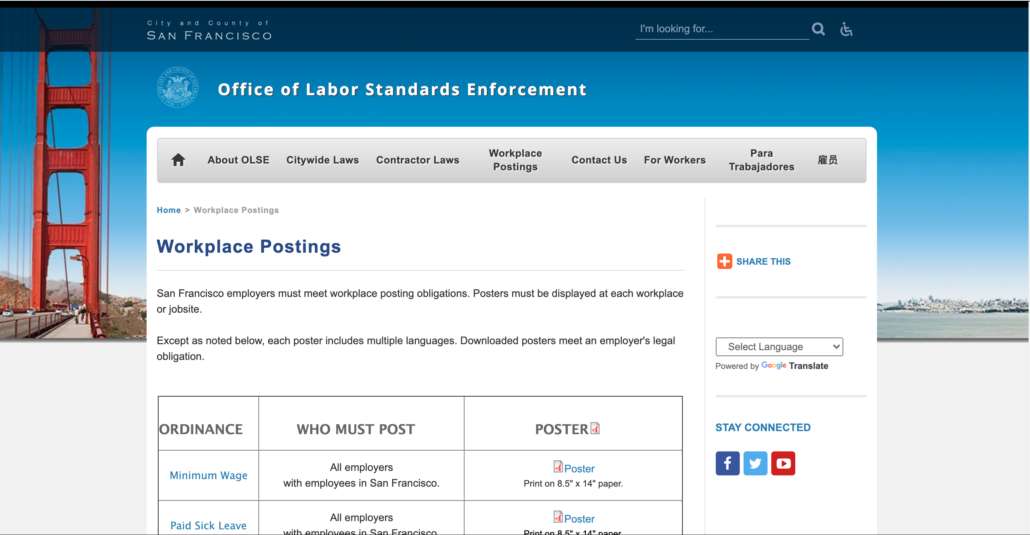

Employers with employees performing work in San Francisco need to know of three changes to local employment laws that take effective July 1, 2020: Minimum Wage Increases to $16.07 Paid Parental Leave Expands to 8 Weeks Updated Required Posters Generally speaking, San...

by nuddleman | May 14, 2020 | COVID-19, New Laws

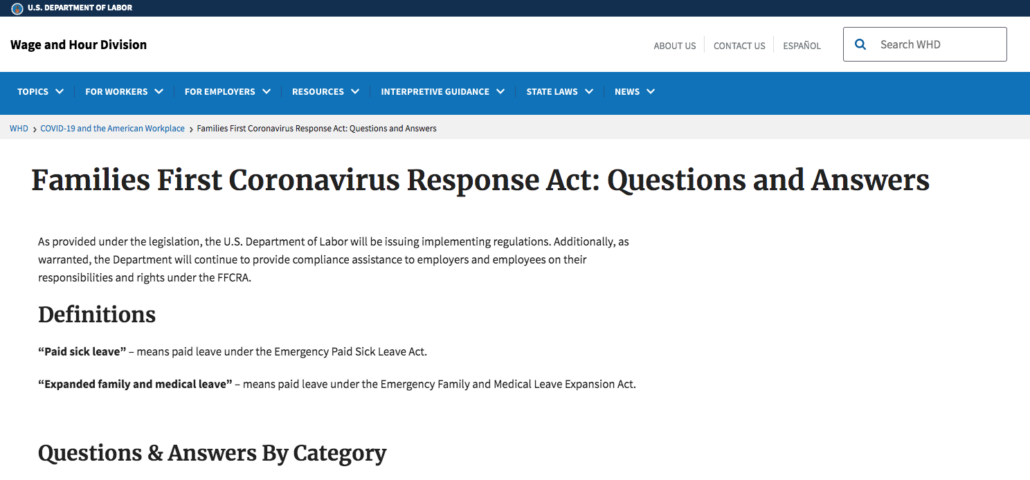

Is that enough abbreviations for you? The Department of Labor just issued a few new answers to frequently asked questions about Emergency Paid Sick Leave and Expanded Family Medical Leave under the Families First Coronavirus Response Act. Now you know why I used the...

Recent Comments