by nuddleman | Oct 26, 2020 | COVID-19, Discrimination & Harassment, New Laws, Wage & Hour

End of Legislative Session Brings Several Changes to the California Workplace The combination of the continuing COVID-19 pandemic and the clock running out on this year’s legislative session produced a lot of tweaks to California employment law, ranging from workers’...

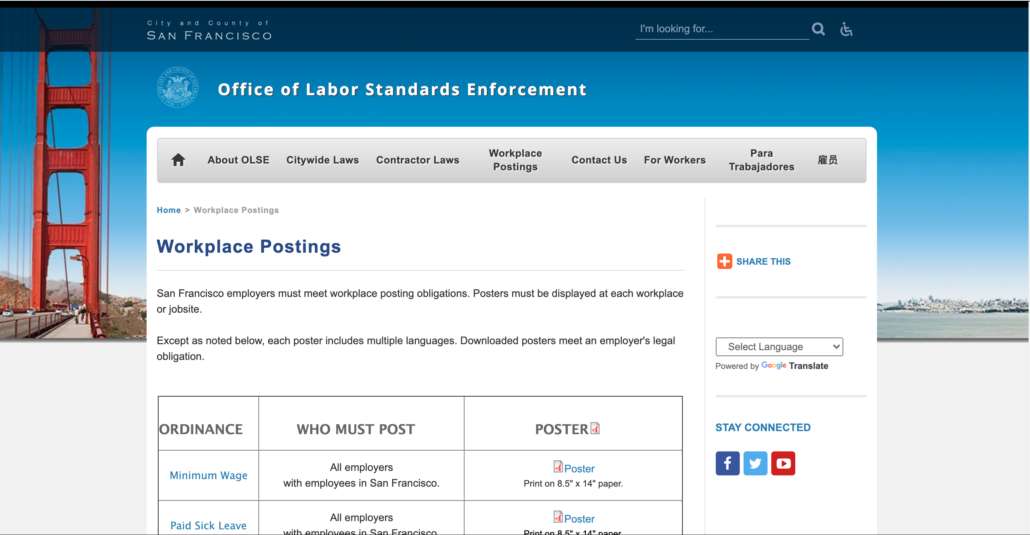

by nuddleman | Jun 30, 2020 | New Laws, Wage & Hour

Employers with employees performing work in San Francisco need to know of three changes to local employment laws that take effective July 1, 2020: Minimum Wage Increases to $16.07 Paid Parental Leave Expands to 8 Weeks Updated Required Posters Generally speaking, San...

by nuddleman | Aug 1, 2019 | Wage & Hour

“On-call” time may be compensable in some instance, and not compensable in others. It has to whether you are “engaged to wait,” or “waiting to be engaged.” They may sound the same, but one is compensable and the other is not. In Ward v. Tilly’s, Inc., the court had to...

by nuddleman | Jul 25, 2019 | Wage & Hour

Almost every wage and hour lawsuit and Labor Commissioner claim that I’ve seen in the past 10 years has included a claim for missed meal and/or rest breaks. Employers who fail to provide at least one half-hour unpaid meal break whenever an employee works more than 5...

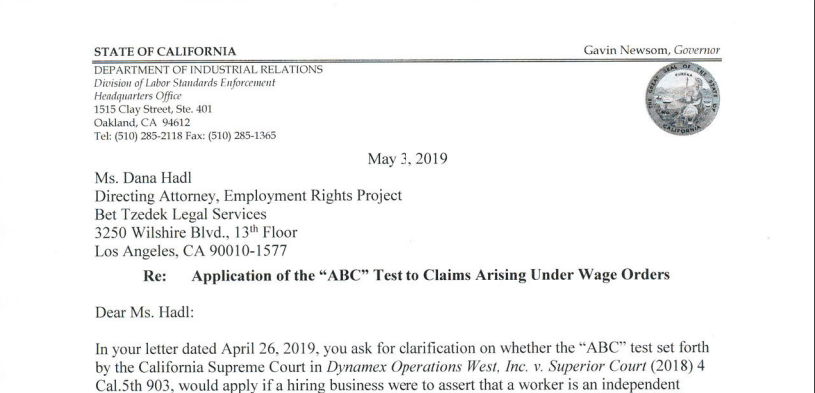

by nuddleman | Jul 1, 2019 | Wage & Hour

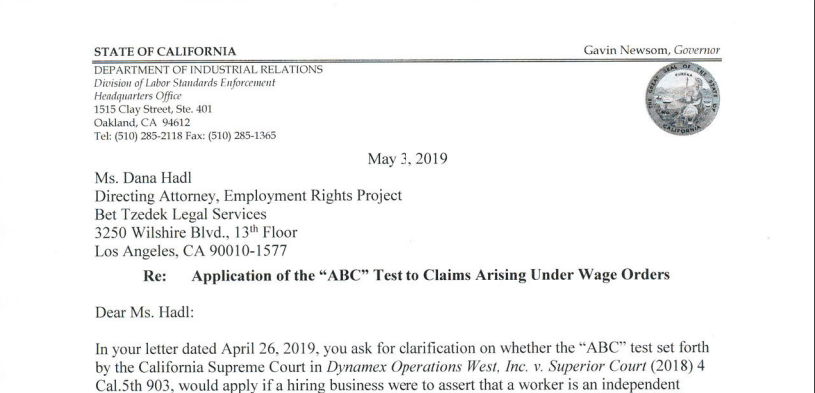

The ABC Test established by Dynamex made it difficult for employers to classify workers as independent contractors for claims “under the wage orders.” But what does that really mean? Which cases are “claims under the wage orders?” Not surprisingly, the Labor...

by nuddleman | Jun 20, 2019 | Wage & Hour

Gbolahan Sarumi probably thought it was a good idea to appeal the Labor Commissioner decision. He obviously believed the employee was not entitled to the money awarded, or at least that Gbolahan was not responsible for the payment. He filed his appeal to Superior...

Recent Comments