End of Legislative Session Brings Several Changes to the California Workplace The combination of the continuing COVID-19 pandemic and the clock running out on this year’s legislative session produced a lot of tweaks to California employment law, ranging from workers’...

End of Legislative Session Brings Several Changes to the California Workplace The combination of the continuing COVID-19 pandemic and the clock running out on this year’s legislative session produced a lot of tweaks to California employment law, ranging from workers’...

The Federal Family Medical Leave Act (“FMLA”) and the state equivalent California Family Rights Act (“CRFA”) require employers with 50 or more employees working within a 75-mile radius to provide up to 12 weeks of unpaid time off for serious or chronic medical...

The Federal Family Medical Leave Act (“FMLA”) and the state equivalent California Family Rights Act (“CRFA”) require employers with 50 or more employees working within a 75-mile radius to provide up to 12 weeks of unpaid time off for serious or chronic medical...

California employers with 5 or more employees must provide sexual harassment prevention training for all employees every two years. Supervisors must receive 2-hours of training. All other employees must receive at least 1-hour of training. The training must cover...

California employers with 5 or more employees must provide sexual harassment prevention training for all employees every two years. Supervisors must receive 2-hours of training. All other employees must receive at least 1-hour of training. The training must cover...

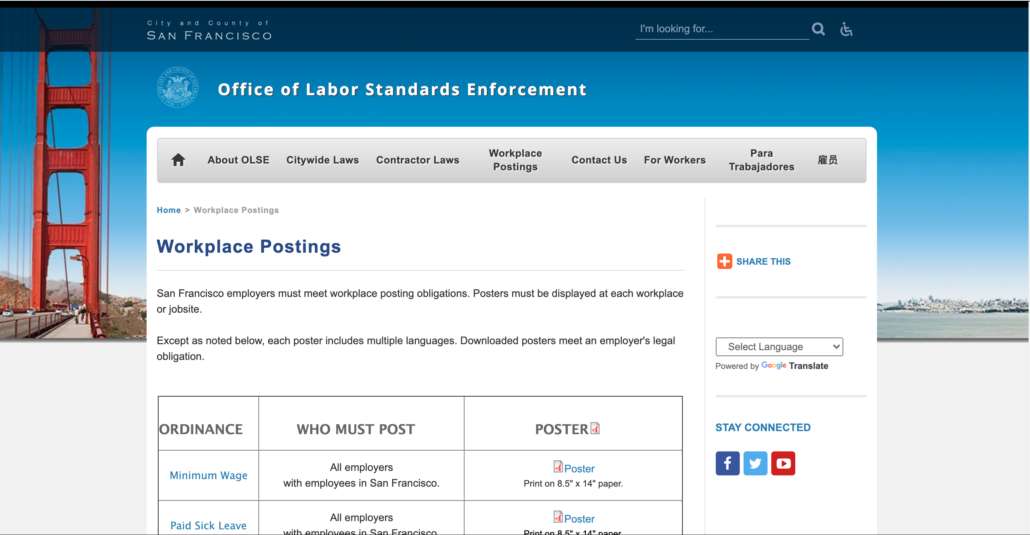

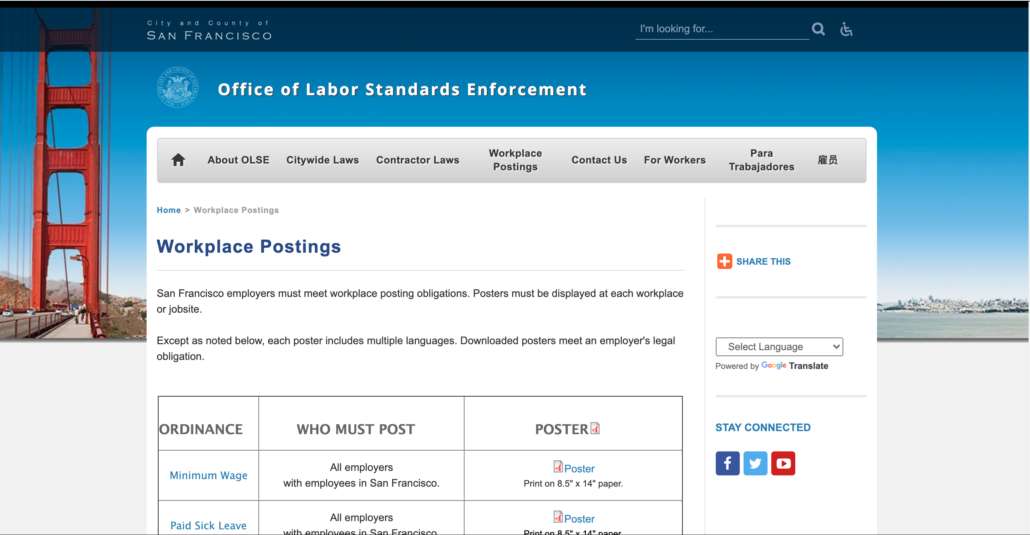

Employers with employees performing work in San Francisco need to know of three changes to local employment laws that take effective July 1, 2020: Minimum Wage Increases to $16.07 Paid Parental Leave Expands to 8 Weeks Updated Required Posters Generally speaking, San...

Employers with employees performing work in San Francisco need to know of three changes to local employment laws that take effective July 1, 2020: Minimum Wage Increases to $16.07 Paid Parental Leave Expands to 8 Weeks Updated Required Posters Generally speaking, San...

In the long fight for equality, the Supreme Court officially ruled that dismissing an employee for being homosexual or transgender violates the Civil Rights Act of 1964 under Title VII. In 1964, Congress “outlawed discrimination in the workplace on the basis of race,...

In the long fight for equality, the Supreme Court officially ruled that dismissing an employee for being homosexual or transgender violates the Civil Rights Act of 1964 under Title VII. In 1964, Congress “outlawed discrimination in the workplace on the basis of race,...

Recent Comments